Sizing Markets That Don't Exist: TAM Lessons

Market sizing of TAMs is an increasingly popular, yet difficult exercise to undertake. This guide addresses five key dilemmas that arise during client work.

Market sizing of total addressable markets (TAM) has been around for some time now, but is evolving from a consulting card trick, to a core skill required in funds and business of all sizes. Effective market sizing requires an ingredient list of strong financial modelling acumen, data parsing, business strategy, future-gazing and a creative mindset to mix it all together.

I've been sizing markets for a number of years and I can attest to its demands and the rewards it brings clients. It's something that I got into almost by accident, but have since found it to be an underserved market. A goal of mine is to find some ways of applying software to the process, while maintaing a bespoke human touch. Meta alert: the TAM for Market Sizing is large, yet the market disintermediated and subscale.

The Value-Add of Market Sizing

As a strategy exercise, market sizing is enjoyable to undertake. It has the right blend of mental gymnastics and proactive validation of value-add. Some of the actionable outcomes I've seen from exercises are:

- Optimal location in a new continent to relocate an HQ

- Proposed secondary market was more lucrative than the primary

- Product was too niche and should be shelved

- Enterprise-level division would face too many hurdles to enter a crowded new market

TAM tasks can be daunting in terms of managing expectations and time. Often I am facing a question that seems incomprehensive. How do I:

- Size a market that doesn't yet exist?

- Level myself up to learn about a new market?

- Get to an end result if the data isn't there?

- Present insight in a cogent manner?

- Balance being as specific as possible, with an all-encompassing framework?

In this article, I will present some lessons learned from over five years' worth of market sizing work across funds, corporate and startup clients on TAM exercises, ranging from plastic wine bottles to AI chip technology.

1) How Do You Size Markets That Don't Exist?

When I stake my claim to size a market, I find that a distinct advantage is having no prior experience in the sector. Depending on who the client is, their underlying biases tend to either be optimistic (entrepreneurs), or pessimistic (investors.) Playing a devil's advocate view to either ultimately serve clients best.

My first instinct is to think about the defining user behaviour that will result in the market materialsing, which detaches myself from the present concept. For example, if one was to size the market for the colonialisation of Mars, the lack of any ex-post data about it (i.e., it currently doesn't exist) would result in a dead end. As such, the best course of action is to focus on probability of actions that would lead to travel there:

- Feasible conditions for human life

- Commercial reasons (e.g., mining or leisure)

- Scientific necessity

- Safety concerns (e.g., terminal climate change or war on Earth)

With those in mind, we can then focus on the action drivers, which (hopefully) are more accessable from data. A cursory look into what's out there, shows studies exist about Martian terraforming, mineral composition, travel cost and Earth doomsday scenarios/probabilities.

Such anchors are mere starting points for a TAM exercise, but the example shows that you have to find the catalyst for a market forming, instead of elements of the intended end result.

2) How Can I Level Up To Learn a New Market?

Learning about new market is a positive externality of doing a TAM exercise; you will finish up smarter whence you began. The internet makes researching straightforward to execute, but with pitfalls common to the medium. In terms of red herrings and poor quality information, I recommend paying heed to the following:

- Content from industry players talking up their market:

- While salient points can be garnered from referenced statistics, any article where you can already guess the conclusion based on the author angle may suffer from selected bias.

- Balance your view by reading from different view points:

- Detach from your personal beliefs and strike a balance between, say, left and right politics.

- Reverse engineering another TAM will compromise your objectivity and understanding.

- Data from small subsets or homogenous usergroups. For example, a forum poll.

Good data is always out there, just with effort required to find it. The gamification of SEO has resulted in many first page search results being a combination of redundant, recycled or half-baked information. Sincere insight usually doesn't come with SEO considerations, so further perseverance is often required.

- Social network niches: Hacker News, Redditt and Twitter can stimulate micro-conversations between valued experts

- Blog niches: Writers who zero in on topics through their Medium, Substack, or personal websites can often unearth valuable sources via their obsessions

- Academic research papers

- Equity and macro research from financial institutions

- Government statistics: Often the cleanest, accurate and most importantly, free, sources out there

- Supranational organisations: UN, World Bank, IMF, etc.

- Content marketing from data gatekeepers: Press releases will often show important headline figures

- Podcasts: Search directories for your keywords and you may find a specific interview with relevancy

- Video: In the early stage of research into a new industry, an audio-visual presentation can be a quicker way of leveling up.

3) Data Isn't Out There?

The uncomfortable truth with most total addressable market exercises is that you tend to do it with missing data. The task exists as a skill because a cursory Google search proves insufficient.

Part of the mental stimulation of market sizing is building a "chain" in order to splice available data into a characteristics of a market. For example:

- Meal kits: Households > income > culinary tastes > cookbook sales > subscription churn (mobiles, TV etc) > takeaway statistics

- Remittances: Immigrant percentages > saving:consumption ratios > FX spreads > wire fees > proportion of country GDP from remittances

- Micromobility: Urban population > public transport journeys below 5km > weather statistics > congestion hotspots

Data comes in primary and secondary forms. When working through the internet I split the latter into three types: Macro, micro and recycled.

- Primary: With limited resources and scale, primary data is hard to undertake in TAM exercises, with the exception of specific bottom-up exercises.

- Macro Secondary: Government-tracked data, academic studies and supranational databases.

- Micro Secondary: Surveys/data from companies pertaining to their industry.

- Recycled Secondary: News, blogs and tweets that take secondary data and interpret it. Over time, in a "Chinese Whispers" way, initial findings get distorted.

When working with data, my process starts with building out a hypothesised chain. I will come up with a list of useful variables and begin searching for them. My hierarchy is always to start with macro secondary sources and then, when avenues are exhausted, move to other options. When I find recycled secondary data, I will work backwards to find the initial source to corroborate (and correct) the findings.

Some tips I have found over the years:

- Use Google Image Search: When you are not entirely sure what you want, searching for data visually is a clearer way of getting to it and helps parse results quicker.

- Consider coding options: If you find a graph without data labels, there are ways of using Python to locate the position of the pixels relative to the axes.

- Constantly link your sources: I usually start off with a scratchpad in Google Sheets where I dump links, images and data points. I will "ring-fence" areas to ensure I don't lose sources

- Use extensions to grab links: E.g., Toby, Evernote, Pocket and OneNote.

- Respect the business models of data providers: While their data may be priced toward deeper-pocketed audiences, there is an inherant cost in its extraction. Misusing free trials may result in an IP block. Politely getting in touch may result in some free queries ran on your behalf, in return for attribution.

- Persevere with PDFs: There are a range of way to copy and paste PDFs into spreadsheets. Some extensions for Chrome can do it to a varying degree of accuracy, but more often than not, pasting as values and splitting text to columns will suffice.

4) How to Present Insight?

There is no template for presenting a TAM, you will build a table and find that in some the progression goes vertically, others horizontally.

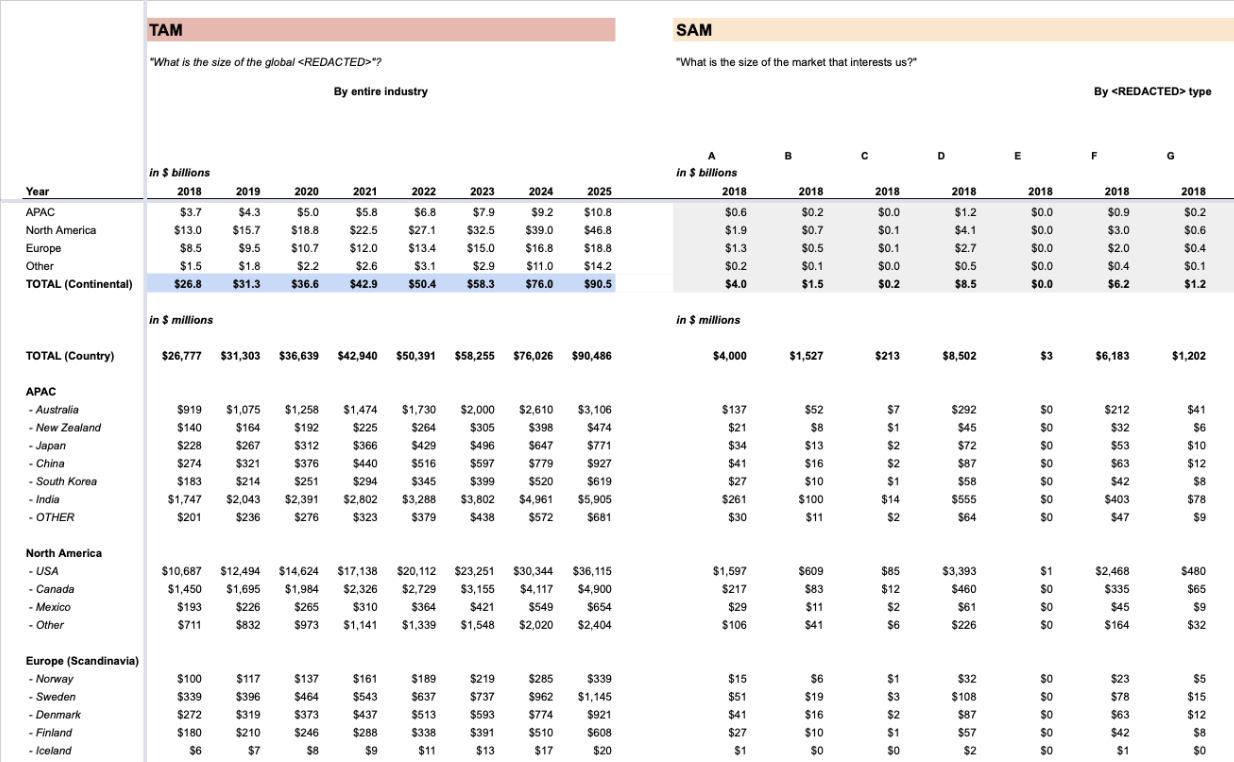

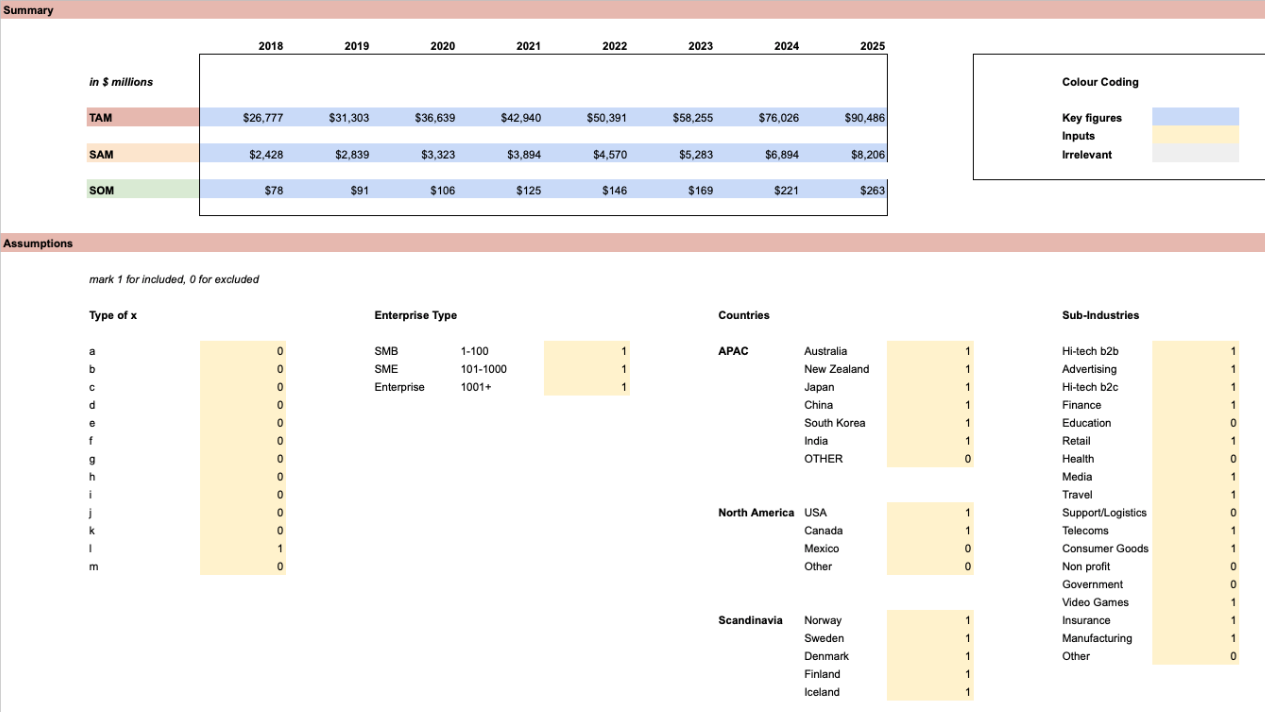

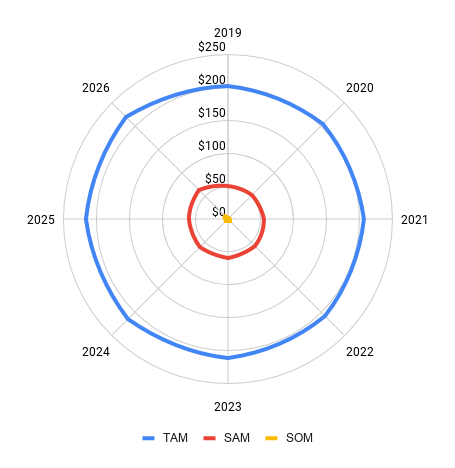

The key is to have a logical flow, where readers can start at a macro level, see the steps toward calculating TAM and then move through the SAM and SOM.

Oftentimes, stakeholders won't want to dig into the weeds, but it's important to justify the methodology by having everything out in the open. A summary visual output tab works for getting the message across succintly.

My optimal spreadsheet structure is as follows

- Summary: Visual output and takeaways.

- Assumptions: All hard-coded cells in one place, so stakeholders can change variable figures in unison. These are typically internally-focused numbers like target price, growth rate, etc.

- TAM Calculation Model

- Appendices/Elaboration: I will use a column/row in the model to link every source used within calculation steps, but it's usually best to link to an appendix where you can use screenshots and calculations to show clarity.

As with any model, consider who the end user is and what value they can derive from it. Don't just dump a 20 megabyte file with varying pastel shades into their inbox. Instead try to guide insight and decision making.

1. Use charts on the Summary tab. If you are showing annual TAM progressions (for changing markets), then a standard line/spider chart will suffice.

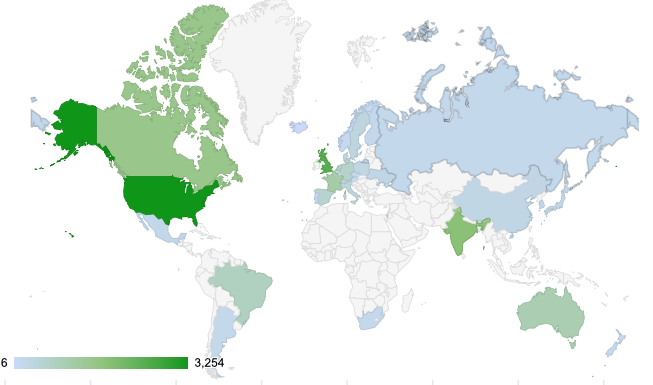

2. For more geographical nuance, harness Google Sheets' excellent map charts.

3. Write up your methodology in a document. You can then use this to link any files used and the writing process acts as a sense check to the rationale.

4. Consider using video walkthroughs for extra colour.

5) Niche vs Specific

For global TAMs, there comes a point where you have to draw a line in the sand and find all-encompassing data modifiers.

I recommend using as many regional data points and modifiers as you can, but you have to be able to apply data to other regions. For example, if you are looking for something like "hours playing video games", it's unlikely that such data exists on a micro level (state-by-state). While it may be possible to search for each region individually, it will result in time wasted and compromised data validation (i.e. 2019 vs 2012 data.)

Instead, focus on finding a clean, up-to-date and reliable macro point and then apply it to sub-regions using modifiers. Based on the market in question these could be the following:

- Economic: GDP, PPP, etc,

- Geographical: Land area, urban density, etc,

- Biological/Ecological: Species coverage, weather patterns, etc,

- Demographic: Gender, religion, salaries, professions, etc,

- Sociological: Phone data use, hours playing video games, time in transit, etc.

My rationale is that any compromise in accuracy becomes a zero-sum game; for any inflated figures, there will be deflated ones and overall insight won't be compromised. You need formulas that can be dragged across all cells, limit the number of VLOOKUP modifiers to three.

The litmus test is when you can apply data to a region that is clearly going to be a small market and, despite some factors being in its favour (like size and population), the end result still comes out to the realistic low result. I call this the Alaska Effect: A large geographical region with abundant wealth in certain resources, but sparsely populated and with low economic activity.

Come to a realisation that there is no data out there that is all-encompassing, you need to stand on the hill and make assumptions.

Why has Market Sizing Risen to Prominence?

In the past, TAM figures would be plucked out of the sky, or from a third party report, and used indiscriminately as a confirmation bias mechanism. Nowadays, they are a vital tool for budging and investment appraisal. Commercial due diligence by funds is also moving from a box ticking exercise, to real forensic analysis about current, and future, commercial credentials of a business.

A number of trends I have observed are contributing to the rise of the TAM:

The Acceleration of Change

As events of 2020 show, markets change very quickly and flexibility is key. The diminishing lifespan of companies is a trend that has been ongoing for the past 60 years. Change accelerates because the moats that protect market position have been shifting from the tangible, to intangibles of the digital realm. Intangibility is more fungible and, perhaps, fairer than physical clout.

Competitive and High(er) Stakes Nature of Dealmaking

Elite investors always get the best deal flow, but because the amounts being invested are higher, the stakes are rising in tandem. Testing assumptions about a company's market are necessary and, if wrong, can unravel the deal economics. Competition for deals is stronger and less chummy: Bidders need proprietary intelligence to gain advantage over competitors. Higher valuation multiples for assets require stronger governance mindsets to really get into the numbers and possibilities for multiple expansion.

Accountability is Higher

The rise of the investor-operator mindset is encouraging investment decisions to be made more holistically. Perhaps in the past, an investor could be agnostic towards the credentials of a deal's product, so long as the financial model made sense. As investing shifts style towards growth, attention on top-line realities, over financial engineering, means that spreadsheets titled "Market Sizing" are becoming more popular.

Horizontal Integration

Integration across markets is an attractive corporate development tool. Businesses are looking more into expanding reach into new segments. Acquisitions are becoming more about buying into a new market, instead of doubling down on capacity within current ones.

Manage the Engagement Proactively

Enter a market sizing exercise with an open mind and create an objective testing environment. End results smaller or larger than the original hypothesis are successful outcomes: They show something learned.

I would love to post a TAM template, but there is no one size fits all approach. As such, pay particular emphasis to the presentation of data. Use audiovisual aids like written methodologies, video walkthroughs and summary decks to help deliver the result to laypeople.