VC

State of the Venture Capital Industry in 2019

Over the past decade, venture capital funding has risen by 17% annually to a figure of $254 billion. What factors have contributed to this surge and what do they mean for the industry going forward?

VC

Over the past decade, venture capital funding has risen by 17% annually to a figure of $254 billion. What factors have contributed to this surge and what do they mean for the industry going forward?

Strategy

Treasury teams are powerful functions with the ability to influence all the levers of shareholder returns. Yet, often such teams are structured, staffed, and incentivized poorly.

VC

Would investing in startups for a capped return, repaid over time, be a more sustainable alternative to hypergrowth investing?

Life

What are the stigmas attached to running a single-person startup, are they valid or just scaremongering? I then present a playbook for potential solo founders thinking about starting a new venture.

Economics

What are economic moats and how are they constructed? Some argue that they are a necessity to retain market position, while others see them as negative and uncreative.

VC

Open-ended or evergreen funds can be beneficial for venture capital investing due to the alignment, flexibility and transparency they bring between stakeholders. In a discussion with a GP who raised an open-ended VC fund, the potential of this asset class is explored.

Strategy

The popular fintech narrative is startups using technology to disrupt incumbent banks. How can banks respond better to the “fintech vs banks” movement?

Strategy

How have Michael Porter's competitive strategy frameworks translated to the digital economy? Three recent case studies are presented and analysed.

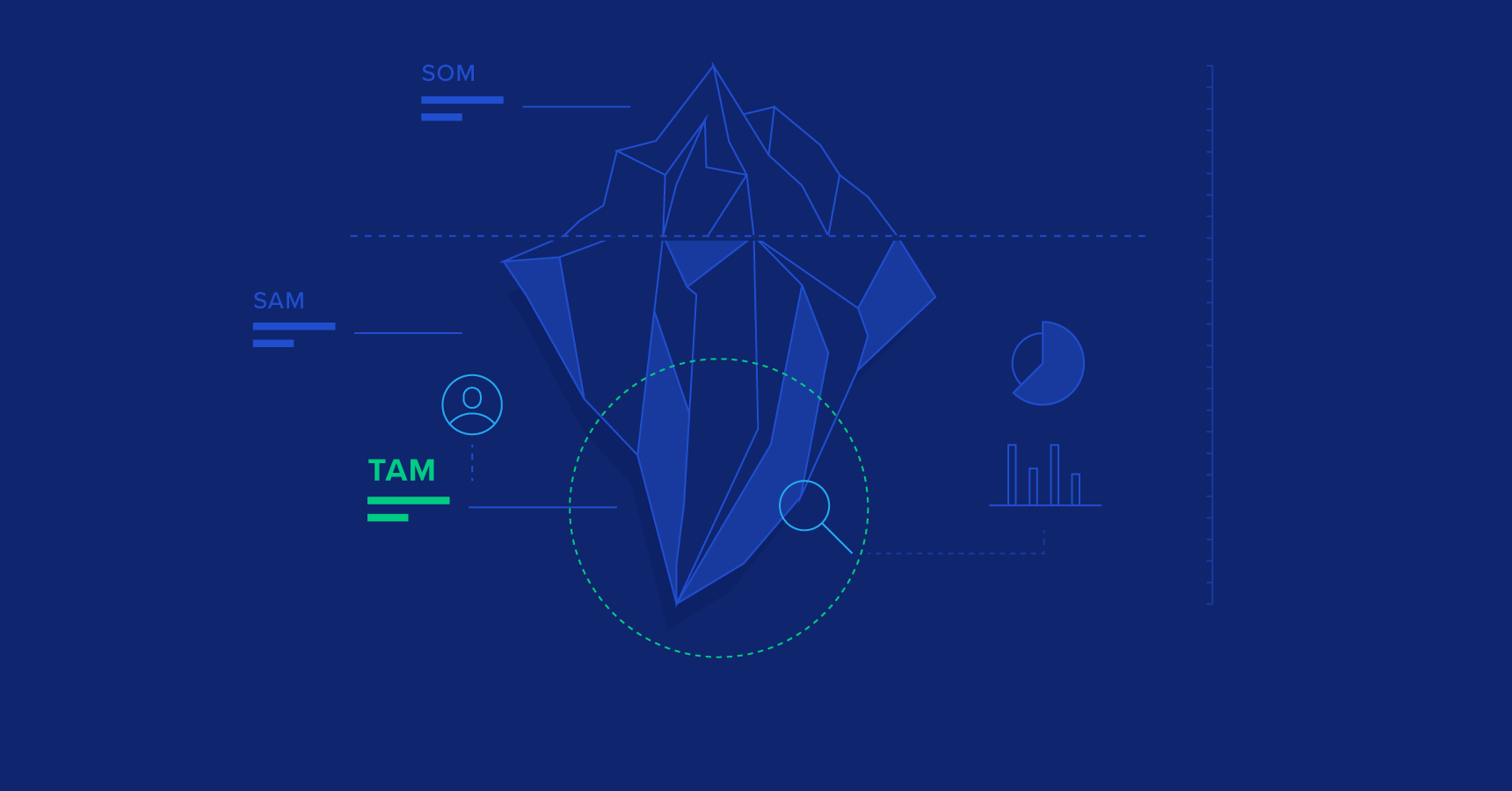

Tutorials

Often miscalculated and misused, TAM, SAM and SOM are critical for managers and investors to understand revenue potential, market positioning and competition.

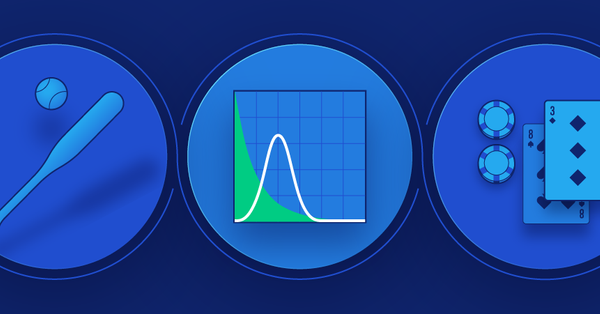

VC

Unlike other asset classes, venture capital returns do not follow a normal distribution curve. Portfolio success is maximized by finding rare deals that bring outsized returns.

Tutorials

Highlighting nine key areas to focus on during term sheet negotiation, this guide explains ownership and financial implications that arise when fundraising.