Frameworks for Gauging AI Opportunities in Professional Services

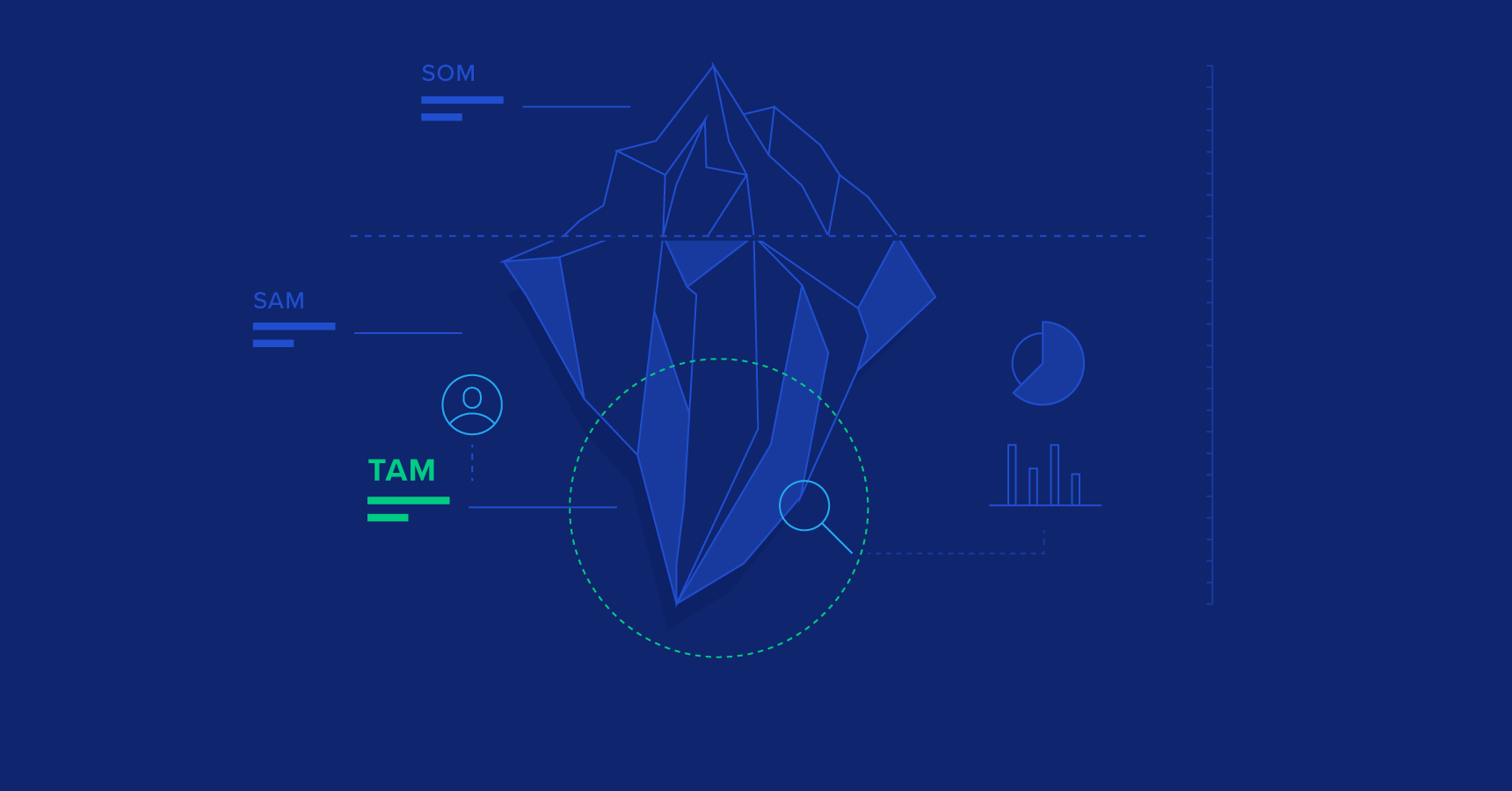

Generative AI doesn't spell doom for professional services. Discover how to assess its impact with strategic frameworks that help owners and investors measure AI effects, understand competitive pressures, and plan responses to drive efficiency and growth.